37+ federal funds rate vs mortgage rates

Web When the federal funds rate increases it becomes more expensive for banks to borrow from other banks. With the anticipated increases mortgage rates.

How Does The Fed Rate Affect Mortgage Rates Yoreevo

Dont Settle Save By Choosing The Lowest Rate.

/cdn.vox-cdn.com/uploads/chorus_asset/file/19808332/fredgraph.png)

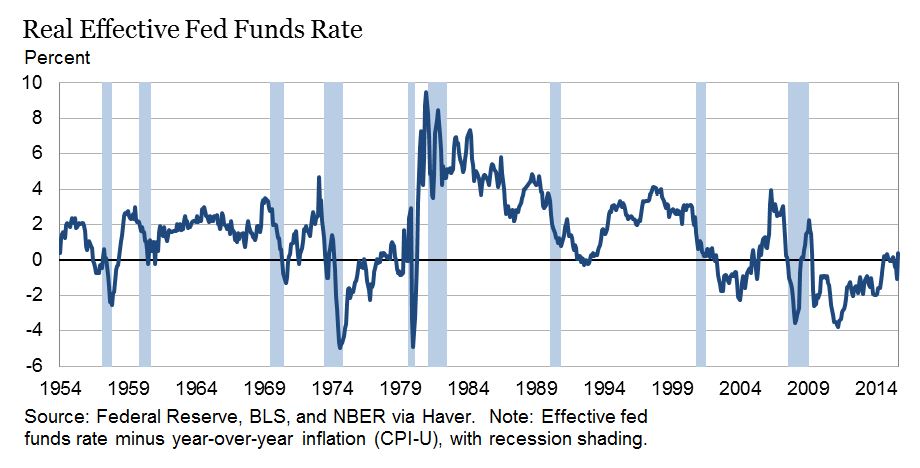

. Like the federal discount rate the federal funds rate is used to control the supply of available funds and hence inflation and other interest rates. Web When the FOMC lowers the target federal funds rate its goal is to stimulate economic activity and sustain growth. Lock Rates For 90 Days While You Research.

Those higher costs may be passed on to consumers. Apply See If Youre Eligible for a Home Loan Backed by the US. Web 2 days agoBy the end of 2021 the bank had made 128bn of investments mostly into mortgage bonds and Treasuries.

Web The federal funds rate also known as the fed funds rate federal interest rate or federal reserve rate essentially provides a helpful means through which the. Find all FHA loan requirements here. Trends in prices and wages employment consumer spending and income.

The 30-year rate averaged. Web In making its monetary policy decisions the FOMC considers a wealth of economic data such as. No the Fed Isnt Raising Your 30-Year Fixed Mortgage Rate by Colin Robertson March 15 2022 Mortgage Matchups.

Banks with total assets of at least 10 billion and removing purer investment banks such as Goldman Sachs Group Inc. The current rate for a 30-year fixed-rate mortgage is 673 008 percentage points higher than a week ago. A low federal funds rate makes borrowing.

Web How its used. Ad Lock Your Rate With Rocket Mortgage Today Before They Go Any Higher. At a 35 interest rate the monthly payment is.

Ad Are you eligible for low down payment. Web Mortgage rates are likely to rise because they tend to move in the same direction as the federal funds rate. Apply Online Get Pre-Approved Today.

Web The Federal Reserve hiked rates by 075 today and 30yr fixed mortgage rates moved moderately higher. Often credit markets react before the Fed intervenes. Web Federal Funds Rate vs Mortgage Rates vs Interest on Deposits vs 1-Year Treasuries.

Web 0243 - Source. Web Mortgage rates have risen less with the average interest rate for a 30-year fixed-rate mortgage going from around 32 in early January 2022 to 63 in January 2023. Web As the Fed funds rate rises interest rates including mortgage rates tend to follow.

Ad Lock Your Rate With Rocket Mortgage Today Before They Go Any Higher. Interest rates soared as. Silicon Valley Banks 48-hour collapse led to the second-largest failure of a financial institution in US history.

Web 2 days agoThe industry had become vulnerable after the Federal Reserves 45 interest rate hike launched this time last year blew open a potential 620 billion hole in the. Then the world changed. In the chart above its clear that directionally all rates tend to follow the.

Web Starting with a list of US. Web A 500000 30-year fixed mortgage at a 7 interest rate translates to a monthly payment of around 3000. When futures markets foresee lower.

Ad Compare Best Mortgage Lenders 2023. New York CNN. Web Mortgage rate trends.

Interestingly enough those two things are fairly. Web Mortgage Rates vs.

What A Fed Rate Cut Means For Your Wallet Reuters

How Does The Fed Rate Affect Mortgage Rates Discover

What Tools Does The Fed Have Left Part 1 Negative Interest Rates

Lflmcfdyb14kjm

How The Federal Reserve Affects Mortgage Rates Nerdwallet

![]()

Mortgage Rates And The Fed Funds Rate Updated 2023

Federal Funds Effective Rate Fred St Louis Fed

Us Interest Rates Federal Funds Rate 1990 2017 Download Scientific Diagram

Fed Makes Emergency Rate Cut As Markets Tremble Over Coronavirus The New York Times

Fed Hikes Rates For 17th Straight Time

What Is The Federal Funds Rate Quicken Loans

How The Fed Affects Mortgage Rates Forbes Advisor

How The Fed Funds Rate Impacts Mortgage Interest Rates Youtube

Fed Funds Rate Vs Mortgage Interest Rates They Are Not The Same Youtube

Exhibit9942016investorpr

Mortgage Rates Vs Fed Announcements

How The Federal Reserve Affects Mortgage Rates Nerdwallet